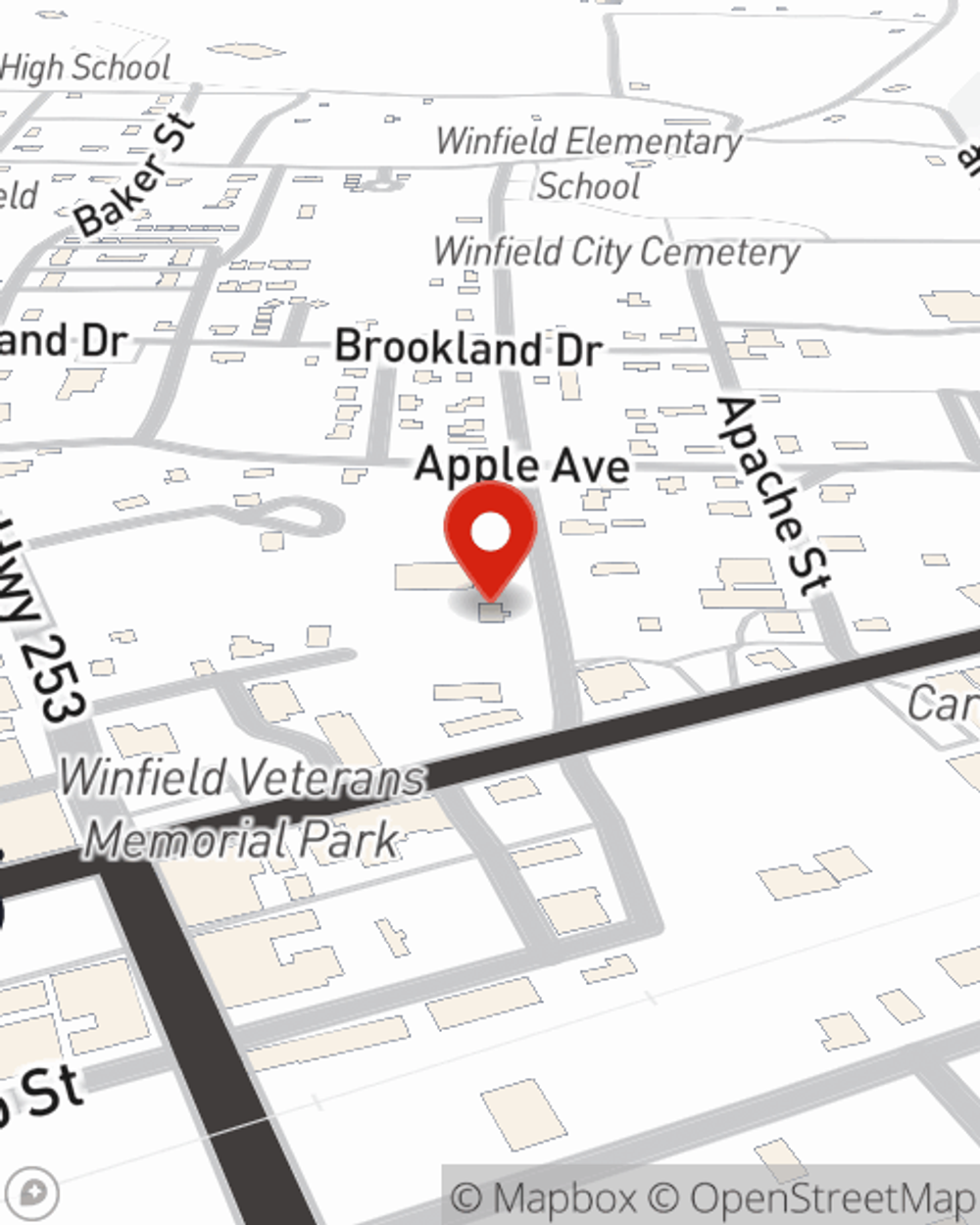

Life Insurance in and around Winfield

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Winfield

- Guin

- Brilliant

Your Life Insurance Search Is Over

When facing the loss of a family member or a loved one, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and come to grips with a new normal devoid of the one who has died.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Put Those Worries To Rest

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less stressful. Life insurance provides financial support when it’s needed most. Coverage from State Farm provides space to grieve without worrying about expenses like ongoing expenses, future savings or phone bills. You can work with State Farm Agent Kevin Bradford to show care for your loved ones with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

With reliable, caring service, State Farm agent Kevin Bradford can help you make sure you and your loved ones have coverage if life doesn't go right. Call or email Kevin Bradford's office now to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Kevin at (205) 487-3232 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Kevin Bradford

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.